In the dynamic world of forex trading, having a deep understanding of the key indicators that can influence market movements is essential for making informed decisions. Whether you are a seasoned professional or just starting out in the industry, mastering these indicators can significantly enhance your trading strategies. Let's delve into the top 10 forex trading indicators that every trader should know.

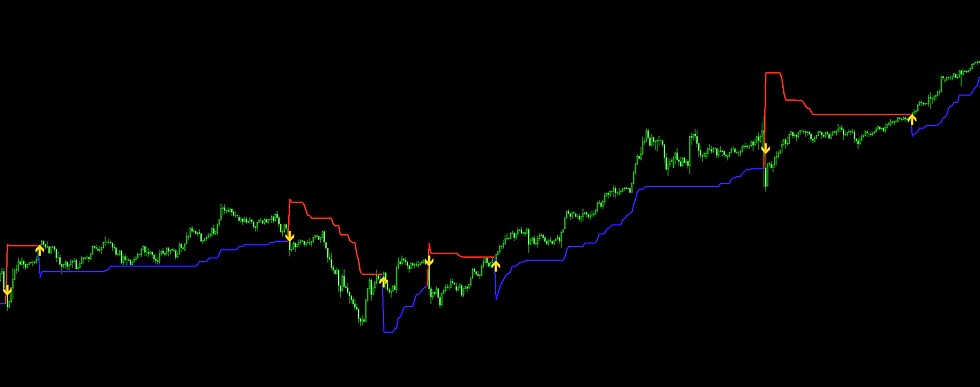

1. Super Trend Indicator

The Forex Super Trend Indicator is a game-changer in the world of forex indicators for both MT4 and MT5 platforms. Its sophisticated algorithm provides valuable insights into market trends, helping traders make informed decisions and maximize their profits.

The Forex Super Trend Indicator stands out for its premium coding and exceptional accuracy. Powered by cutting-edge technology, this indicator offers unparalleled performance that sets it apart from other indicators.

Navigating the complexities of the forex market can be challenging, but with the Forex Super Trend Indicator, professionals benefit from a user-friendly interface that streamlines the trading process. Its intuitive design allows traders to access crucial data effortlessly.

Flexibility is key in the world of forex trading, and the Forex Super Trend Indicator delivers on this front. Traders can customize settings to suit their trading preferences, ensuring a personalized experience that caters to individual trading strategies.

Key Features of the Forex Super Trend Indicator

The indicator identifies and highlights current market trends, enabling traders to align their positions accordingly.

Precisely signals optimal points to enter or exit trades, enhancing trading efficiency and profitability.

Traders can adjust settings to suit their trading style and preferences, making the indicator versatile and adaptable.

Receive instant notifications when market conditions meet predefined criteria, ensuring timely decision-making.

You can download the Super Trend Indicator by pressing the link below.

Related EAs to the Super Trend Indicator:

2. Half Trend Indicator

In the fast-paced world of Forex trading, professionals are always on the lookout for innovative tools and indicators that can give them a competitive edge in the markets. One such powerful tool that has been gaining traction in the trading community is the Forex Half Trend Indicator.

The Forex Half Trend Indicator is a technical analysis tool designed to help traders identify the prevailing market trend easily. This indicator works by plotting a line on the price chart to represent the current trend direction. By doing so, it assists traders in making informed decisions regarding when to enter or exit trades based on the direction of the trend.

The Half Trend Indicator operates on the concept of moving averages and market momentum. It calculates the average price movement over a specific period and generates buy or sell signals when certain conditions are met. This dynamic functionality enables traders to ride the trend and capture profitable opportunities in the market.

Trend Identification : The indicator effectively identifies the trend direction, allowing traders to align their trades with the prevailing market sentiment.

User-Friendly Interface : With a simple and clear display, traders can easily interpret the signals generated by the indicator, enhancing their trading efficiency.

Customization Options : Traders can customize the indicator settings to suit their trading preferences and strategies, providing flexibility in application.

You can download the Half Trend Indicator by pressing the link below.

Related EAs to the Half Trend Indicator:

3. Hull Moving Average Indicator

The Hull Moving Average (HMA) is a refined moving average indicator that aims to reduce lag while improving smoothness. This indicator is designed to accurately respond to current price movements and filter out market noise. By using weighted moving averages and eliminating sudden price fluctuations, the HMA offers traders a clearer picture of market trends.

The HMA calculates the moving average based on the weighted difference between the current price and a period of historical prices. This unique calculation method ensures that the indicator is more responsive to recent price changes, making it ideal for identifying short to mid-term trends in the forex market. As a result, traders can make more informed decisions based on current market conditions.

Reduced Lag : The HMA reacts faster to price changes compared to traditional moving averages, offering traders timely signals.

Smooth Price Movements : By filtering out noise, the HMA provides a clearer representation of price trends, enabling traders to make better trading decisions.

Trend Identification : The HMA helps traders identify trends more accurately, allowing them to capitalize on profitable opportunities in the market.

You can download the Hull Moving Average Indicator by pressing the link below.

Related EAs to the Hull Moving Average Indicator:

4. Stochastic Oscillator Indicator

The Stochastic Oscillator is a momentum indicator that compares a particular closing price of a security to its price range over a specific period. This oscillator consists of two lines - the %K line, which represents the current price relative to the range, and the %D line, a moving average of %K. By providing insights into overbought and oversold conditions, the Stochastic Oscillator aids traders in identifying potential reversal points in the market.

One of the key strengths of the Stochastic Oscillator lies in its ability to generate buy and sell signals based on divergences and crossovers. When the %K line crosses above the %D line and both lines are below the oversold threshold, it signals a buying opportunity. Conversely, a crossover below the overbought level indicates a potential sell signal. These signals serve as valuable markers for traders seeking to capitalize on market trends efficiently.

The Stochastic Oscillator Indicator is an original MT4/MT5 indicator that can be found in any MT4/MT5 terminal.

Related EAs to the Stochastic Oscillator Indicator:

5. Parabolic SAR Indicator

At its core, the Parabolic SAR indicator is designed to identify potential reversals in price direction. By plotting points on a chart that indicate potential trend reversals, this indicator serves as a valuable tool for traders looking to capitalize on market fluctuations. The indicator appears below price bars when the trend is upward and above price bars when the trend is downward, making it easy to interpret and act upon.

One of the significant advantages of the Parabolic SAR indicator is its versatility in various trading strategies. Whether you are a day trader, swing trader, or scalper, this tool can enhance your decision-making process and improve the accuracy of your trades.

Trend Identification : The Parabolic SAR excels in identifying market trends, making it an invaluable asset for trend-following strategies. When the dots are below the price, it indicates an uptrend, while dots above signify a downtrend.

Setting Stop Loss : Utilizing the Parabolic SAR for setting stop-loss orders can protect your profits and limit potential losses. As the dots move closer to the price, it suggests tightening your stop-loss to secure gains.

Confirming Reversals : In conjunction with other technical indicators, the Parabolic SAR can confirm potential trend reversals, providing validation for entry and exit points.

The Parabolic SAR Indicator is an original MT4/MT5 indicator that can be found in any MT4/MT5 terminal.

Related EAs to the Parabolic SAR Indicator:

6. Moving Average Indicator

This indicator smoothens out price data to form a trend-following indicator that reveals the direction in which an asset’s price is moving. By calculating the average price over a specified period, the Moving Average unravels crucial insights into market momentum and potential reversal points.

By analyzing the relationship between the asset’s price and its Moving Average, traders can identify prevailing trends, be it uptrends, downtrends, or ranging markets. This serves as a compass to navigate the turbulent waters of forex trading with confidence and clarity.

The Moving Average acts as a strategic tool to pinpoint optimal entry and exit points for trades. Crossing of price above or below the Moving Average can signal potential buy or sell opportunities, aiding traders in making well-informed decisions.

Selecting the Right Moving Average Type : Whether Simple Moving Average (SMA), Exponential Moving Average (EMA), or Weighted Moving Average (WMA), choose the type that aligns best with your trading objectives.

Choosing the Timeframe : Tailor the period of the Moving Average to suit the volatility of the assets you're trading. Shorter periods are ideal for short-term traders, while longer periods cater to those eyeing long-term trends.

Combining with Other Indicators : Enhance the potency of the Moving Average indicator by pairing it with complementary tools like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) for a comprehensive trading strategy.

The Moving Average Indicator is an original MT4/MT5 indicator that can be found in any MT4/MT5 terminal.

Related EAs to the Moving Average Indicator:

7. Bollinger Bands Indicator

The Bollinger Bands Indicator, developed by John Bollinger, consists of three bands – a simple moving average (SMA) in the middle and two standard deviation bands above and below the SMA. These bands dynamically adjust to market volatility, expanding during fluctuations and contracting during stable periods. By analyzing the relationship between price and volatility, traders can identify potential entry and exit points with remarkable accuracy.

Integrating the Bollinger Bands Indicator into your trading arsenal opens up a world of possibilities to optimize your strategies. Whether you are a seasoned professional or a novice trader, consider the following tips to maximize the potential of this powerful tool:

Combining with Other Indicators : Experiment with combining Bollinger Bands with oscillators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) for comprehensive market analysis.

Setting Realistic Targets : Establish clear profit targets and stop-loss levels based on the signals generated by the Bollinger Bands, ensuring disciplined trading execution.

Adapting to Market Conditions : Recognize that market conditions evolve, and the Bollinger Bands adapt accordingly. Stay nimble and adjust your strategies in response to changing volatility levels.

The Bollinger Bands Indicator is an original MT4/MT5 indicator that can be found in any MT4/MT5 terminal.

Related EAs to the Bollinger Bands Indicator:

8. MACD (Moving Average Convergence Divergence) Indicator

The MACD indicator is a popular momentum oscillator that shows the relationship between two moving averages of a security’s price. It consists of three key components:

MACD Line : The faster-moving average line.

Signal Line : The slower-moving average line.

Histogram : Represents the difference between the MACD and signal line.

By analyzing the interactions between these components, traders can identify potential trend reversals, momentum shifts, and trading opportunities.

Leveraging the Power of MACD in Forex Trading

The MACD indicator can help identify the direction of the trend. When the MACD line crosses above the signal line, it indicates a potential uptrend, while a cross below suggests a possible downtrend.

Divergence occurs when the price of a currency pair moves in the opposite direction of the MACD indicator. This can signal a potential reversal or continuation of the current trend.

The MACD histogram acts as a confirmation tool, validating the strength of a trend. A rising histogram suggests increasing momentum, while a declining histogram may indicate weakening momentum.

The MACD Indicator is an original MT4/MT5 indicator that can be found in any MT4/MT5 terminal.

Related EAs to the MACD Indicator:

9. Relative Strength Index (RSI) Indicator

What is the RSI Indicator? The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It oscillates between 0 and 100 and is typically used to identify overbought or oversold conditions in the market. Traders use the RSI indicator to determine the strength of a trend and potential reversal points.

How Does it Work? When the RSI indicator crosses above 70, it is considered overbought, suggesting a potential sell-off in the market. Conversely, when the RSI falls below 30, it indicates an oversold condition, signaling a possible buying opportunity. By analyzing these levels, traders can make more informed decisions on entry and exit points in their trades.

Leveraging the Power of RSI Indicator in Forex Trading

Identifying Trend Reversals One of the key benefits of the RSI indicator is its ability to signal potential trend reversals. By monitoring the RSI levels in conjunction with price movements, traders can anticipate shifts in market direction and adjust their strategies accordingly. This can help in maximizing profits and minimizing losses.

Confirmation Tool The RSI indicator serves as a valuable confirmation tool for traders. When the RSI aligns with other technical indicators or chart patterns, it strengthens the validity of a trading signal. Combining the RSI with other tools such as moving averages or Fibonacci retracements can enhance the accuracy of your analysis.

Divergence Analysis Another advanced technique that professional traders employ with the RSI indicator is divergence analysis. Divergence occurs when the price movement and RSI indicator move in opposite directions. This divergence can signal potential trend reversals or continuation of the current trend, providing valuable insights for traders.

The RSI Indicator is an original MT4/MT5 indicator that can be found in any MT4/MT5 terminal.

Related EAs to the RSI Indicator:

10. Fibonacci Retracement Indicator

When applied to forex trading, the Fibonacci Retracement levels (23.6%, 38.2%, 50%, 61.8%, and 100%) are horizontal lines that indicate potential support and resistance levels. These levels are calculated based on the ratio of a number to another number two places higher in the sequence. Traders use these levels to identify potential price retracement areas after a significant movement.

The Fibonacci Indicator is an original MT4/MT5 indicator that can be found in any MT4/MT5 terminal.

Related EAs to the Fibonacci Retracement Indicator:

Conclusion

Mastering these top 10 forex trading indicators can significantly enhance your trading strategies and decision-making processes. By incorporating these indicators into your analysis, you can gain valuable insights into market trends, momentum, and potential entry or exit points. Remember, successful trading requires a combination of technical analysis and sound risk management. Stay informed, stay disciplined, and continuously refine your trading skills to navigate the complexities of the forex market with confidence and expertise. Remember, success in Forex trading requires continuous learning, adaptability, and a strategic approach. Equip yourself with the right tools and knowledge to thrive in the ever-evolving Forex landscape. Happy trading!